For many Nepalese living abroad, the desire to reconnect with their homeland isn’t just emotional—it’s also a sound financial strategy. Whether you’re looking to generate passive income, secure long‑term wealth, or leave a legacy for future generations, the opportunity to invest in property in Nepal is gaining traction. This guide will walk you through each step to help you confidently invest in Nepal’s property market from overseas.

Table of Contents

- Introduction

- Step 1: Understand the Nepalese Property Market

- Step 2: Set Clear Investment Goals

- Step 3: Research Legal and Regulatory Requirements

- Step 4: Develop a Financial Plan and Budget

- Step 5: Build a Local Network of Professionals in Nepal

- Step 6: Identify Promising Investment Locations in Nepal

- Step 7: Utilize Technology for Virtual Property Tours

- Step 8: Secure Financing and Explore Funding Options to invest in Nepal

- Step 9: Execute the Investment Process

- Step 10: Manage Your Investment Remotely

- Conclusion

Introduction

Nepal’s property market has seen steady growth in recent years, fueled by urbanization, government incentives, and rising demand for quality housing. For non-resident Nepalese (NRNs) and international investors alike, the prospect to invest in Nepal offers the dual benefits of financial returns and a tangible connection to the homeland. In this guide, we’ll break down the entire process—from initial research to managing your investment from abroad. Hence, you can confidently invest in Nepal and secure a promising future.

Step 1: Understand the Nepalese Property Market

Before diving into any investment, it is crucial to gain a clear picture of the local market dynamics. Here’s how to get started:

Analyze Market Trends

- Growth Patterns: Study how property values have changed over the last few years. Look for reports from trusted sources like InvestAsian and local news outlets to understand market cycles.

- Key Drivers: Identify factors such as urbanization, remittance inflows, and government policies that influence property demand in Nepal.

Understand Economic Indicators

- GDP Growth and Urbanization: A growing economy and rising urban populations typically signal a healthy real estate market.

- Remittance Flows: Since a significant portion of Nepal’s GDP comes from remittances, this directly impacts property demand and affordability.

Knowing these trends will give you a strategic edge when you decide to invest in Nepal.

Also Read: Why Real Estate is the Best Investment Option for Nepalese Abroad

Step 2: Set Clear Investment Goals

Defining what you want to achieve with your investment is a critical early step. Ask yourself:

- What is your primary goal?

Are you looking for long-term capital appreciation, rental income, or a mix of both? - What is your investment timeline?

Are you planning to hold the property for several years or looking for a quick turnaround? - What is your risk tolerance?

Are you comfortable with market fluctuations, or do you prefer a safer, lower-yield investment?

Having a well-defined goal helps tailor your research and decision‑making process, ensuring that when you choose to invest in Nepal, it aligns with your overall financial strategy.

Step 3: Research Legal and Regulatory Requirements

Investing in property from overseas involves navigating a unique set of legal challenges. Therefore, it is better to know in and out about legal and regulatory obligations before in vesting in Nepalese real estate market. Key points include:

Understanding Ownership Laws

- Foreign Ownership Restrictions: In Nepal, foreign nationals are generally limited when it comes to owning freehold land. However, NRNs can own property under specific conditions.

- Company Formation: Often, the recommended route for overseas investors is to establish a Nepalese company or form a joint venture with a local partner to acquire property.

Documentation and Permits

- Essential Documents: Be prepared to gather identification, proof of funds, NRN certificates (if applicable), and property transaction documents.

- Legal Counsel: It is advisable to work with a Nepal‑based lawyer who specializes in real estate. This ensures compliance with the latest regulations and smooth transaction processing.

Thorough legal due diligence is critical when you invest in Nepal to avoid pitfalls and ensure a secure transaction.

Step 4: Develop a Financial Plan and Budget

Proper financial planning can make or break your investment journey. Here’s what to consider:

Calculate Total Investment Costs

- Property Price: Understand the average cost per square meter in your target area. In urban centers like Kathmandu, prices may be higher, whereas rural areas might offer more affordability.

- Additional Costs: Factor in registration fees, stamp duties, taxes, legal fees, and agent commissions. These additional costs can range significantly, so a detailed estimate is essential.

Funding and Financing Options

- Personal Savings vs. Loans: Decide whether you’ll use personal savings or seek financing from banks (both international and local). Note that loan conditions and interest rates in Nepal might differ from those in your home country.

- Currency Exchange: Be aware of currency fluctuations since you’ll need to convert funds to Nepali Rupees (NPR) when you buy property.

A well‑structured financial plan helps ensure that you have a clear budget and can manage risks effectively when you invest in Nepal.

Step 5: Build a Local Network of Professionals in Nepal

Success in overseas real estate investment often hinges on local expertise. Consider assembling a team that may include:

Real Estate Agents and Brokers

- Local Market Knowledge: Experienced agents can offer insights into emerging neighborhoods, pricing trends, and property availability.

- Negotiation Support: They can help you secure a better deal and navigate local market practices.

Legal and Financial Advisors

- Lawyers: Choose someone with deep expertise in Nepalese real estate law to assist with contracts and regulatory compliance.

- Accountants: A local accountant can help manage tax filings and ensure your investment complies with Nepal’s financial regulations.

Property Managers

- Remote Management: Hiring a reliable property manager ensures your investment is well maintained, even if you are overseas. They can handle tenant relations, repairs, and routine maintenance.

A trusted local network not only simplifies the process but also boosts your confidence as you prepare to invest in Nepal.

Step 6: Identify Promising Investment Locations in Nepal

Location is everything in real estate. In Nepal, several areas offer distinct advantages:

Urban Centers

- Kathmandu Valley: Despite higher prices, urban centers like Kathmandu, Lalitpur, and Bhaktapur offer strong potential for both residential and commercial investments. High demand, quality infrastructure, and lifestyle amenities make them ideal for long‑term value appreciation.

- Pokhara: Known for its scenic beauty and tourism appeal, Pokhara is increasingly popular for both vacation homes and rental properties.

Suburban and Emerging Areas

- Rural and Semi‑Urban Regions: Regions outside the main urban hubs are witnessing growth due to lower property prices and government initiatives aimed at decentralizing urban development.

- Investment Hotspots: Areas such as Sunsari, Morang, and Chitwan are currently trending due to affordability and increasing infrastructure development.

Evaluate each location carefully based on factors such as population growth, infrastructure plans, and rental potential to choose the right area to invest in Nepal.

Step 7: Utilize Technology for Virtual Property Tours

Distance is no longer a barrier when it comes to property investment. Technology can significantly simplify your research process:

Virtual Tours

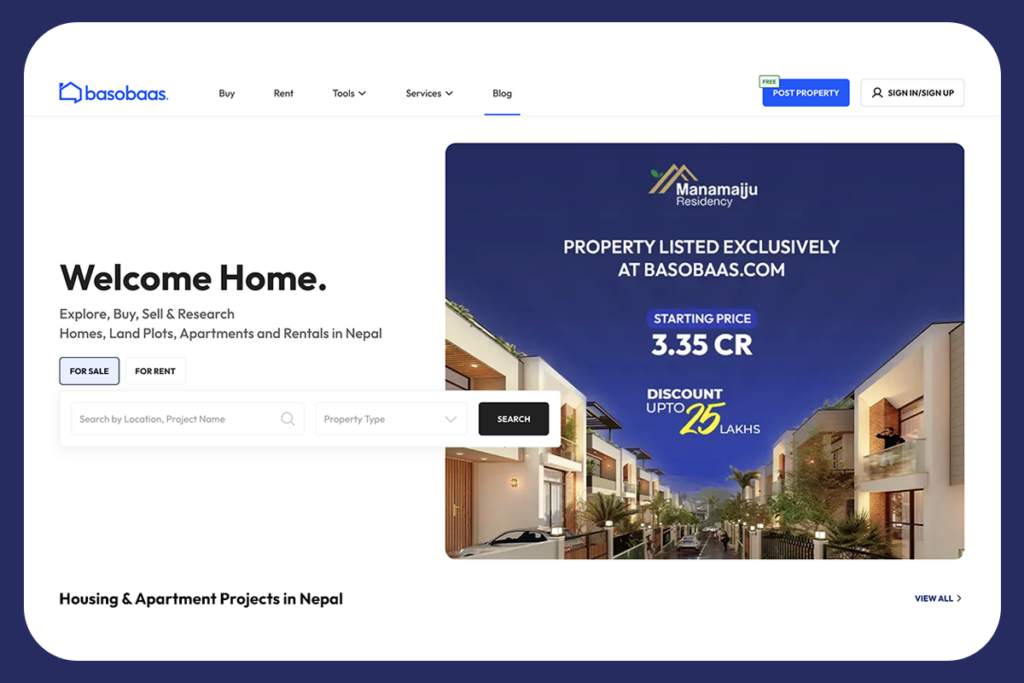

- Remote Viewing: Many property developers and agents now offer virtual tours. Use video conferencing and VR tools to tour properties without physically traveling to Nepal.

- Interactive Platforms: Online portals can provide detailed property listings, neighborhood insights, and market data that can help you make an informed decision.

Embracing these digital tools not only saves time but also enhances your ability to invest in Nepal from anywhere in the world.

Step 8: Secure Financing and Explore Funding Options to invest in Nepal

Access to financing is a critical element for any real estate investment. Here are some steps to secure funding:

Explore Loan Options

- Local Banks: Research Nepalese banks that offer mortgage loans to NRNs and foreign investors. Compare interest rates, loan terms, and eligibility criteria.

- International Financing: If local loans are not accessible, consider international lenders who specialize in overseas real estate financing.

Prepare Your Financial Documents

- Proof of Income and Assets: Compile bank statements, tax returns, and other financial documents to present a strong case for financing.

- Creditworthiness: A strong credit history enhances your chances of securing favorable loan terms.

Securing reliable financing allows you to execute your plan confidently as you choose to invest in Nepal.

Step 9: Execute the Investment Process

With your research completed, financial plan in place, and a solid local network, you’re ready to execute the investment:

Negotiation and Offer

- Property Valuation: Get a professional property valuation to ensure you’re paying a fair price.

- Negotiation: Work with your local agent and lawyer to negotiate the best possible deal. Consider factors like payment terms, closing costs, and potential future development plans.

Due Diligence

- Verify Documents: Ensure all property titles, registration documents, and permits are in order.

- Site Visits: If possible, schedule an in-person visit to inspect the property and verify its condition.

Finalizing the Purchase

- Contract Signing: Once negotiations are complete, sign the purchase agreement with the help of legal counsel.

- Payment and Transfer: Complete the payment process, ensuring all taxes, fees, and other costs are settled. Finally, register the property with the relevant government authorities.

Following these steps ensures a secure and legally compliant transaction when you invest in Nepal.

Step 10: Manage Your Investment Remotely

Once your property purchase is complete, the next challenge is managing your investment from overseas. Consider these strategies:

Hire a Property Manager

- Local Oversight: A dedicated property manager can handle day‑to‑day operations, maintenance, and tenant relations on your behalf.

- Regular Updates: Ensure you receive regular updates on the property’s performance, rental income, and any maintenance issues.

Leverage Technology

- Online Platforms: Use online tools and property management software to monitor your investment remotely.

- Digital Communication: Maintain regular communication with your manager and local advisors through video calls, emails, or messaging apps.

Regular Market Reviews

- Stay Informed: Keep an eye on market trends, economic indicators, and policy changes in Nepal. Regular market reviews allow you to adjust your strategy if needed.

- Plan for Growth: Consider reinvesting rental income or selling the property at the right time to maximize returns.

Effective remote management is essential to ensure that your decision to invest in Nepal continues to yield positive results over the long term.

Conclusion

Investing in property in Nepal from overseas can be a rewarding endeavor—both emotionally and financially. By following this step‑by‑step guide, you can navigate the complexities of the Nepalese real estate market with confidence. From understanding market trends and setting clear investment goals to building a strong local network and leveraging digital tools, each step is designed to help you make informed decisions and optimize your investment strategy.

As you prepare to invest in Nepal, remember that due diligence, persistence, and a well‑structured plan are your best allies. Whether you’re an NRN looking to secure your roots or an international investor seeking new opportunities, Nepal’s dynamic property market offers immense potential. With careful planning and the right partnerships, your investment can contribute to both personal wealth and the ongoing development of Nepal—a country of rich heritage and boundless opportunities.

Got questions or ideas? Let’s talk—comment below!