Buying land or a house in Nepal is one of the biggest financial decisions most families make. It’s not just about finding a place to live—it’s also an investment that can shape your future. Unfortunately, many people fall into traps that cost them money, peace of mind, and sometimes even the property itself.

In this blog, we’ll explore the 5 big mistakes while buying land or a house in Nepal and how you can avoid them. By the end, you’ll have a clear checklist to protect yourself from financial loss and ensure a safe investment.

Mistake 1: Investing Without Research

Too many buyers in Nepal rush into buying property without studying the market. A neighbor or friend says the price will rise, and suddenly, people invest on property blindly. This is risky.

Understanding Market Trends in Nepal

Property prices vary significantly between Kathmandu Valley, Pokhara, Chitwan, and other developing cities. For example, prices in Lalitpur are higher than in outer districts, but not all locations guarantee long-term growth.

Checking Real Market Price Before Buying

Never rely only on the seller’s price. Compare with:

- Government land valuation records

- Local brokers’ insights

- Recent transactions in nearby areas

This helps you avoid overpaying.

Evaluating Future Returns and Growth Potential

Think long-term. Will there be new roads, schools, or businesses nearby? A property in an area with planned infrastructure often appreciates faster.

Pro Tip: Visit the site multiple times at different hours of the day to understand its environment and accessibility.

Mistake 2: Ignoring Legal Papers

One of the most common mistakes while buying land or a house in Nepal is skipping legal checks.

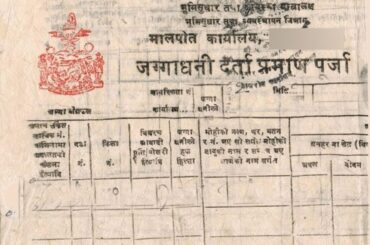

Importance of Land Ownership Documents

Always confirm the land’s Lalpurja (ownership certificate) matches the seller’s name. Fake documents are still a problem in Nepal’s real estate market.

Verifying Registration and Transfer Papers

Check for:

- Encumbrance certificates (ensuring no loans or disputes)

- Clear boundaries in survey maps

- Official registration with the Land Revenue Office

Role of Lawyers in Avoiding Fraud

Hiring a property lawyer may seem expensive, but it’s cheaper than losing your life savings. Lawyers ensure contracts are binding and protect you from scams.

Mistake 3: Not Checking Basic Facilities

Some buyers focus only on the price and ignore essential facilities. Later, they regret their decision.

Essential Infrastructure: Roads, Water, and Electricity

Without proper roads or water supply, daily life becomes a struggle. Even if you build a modern house, lack of electricity or drainage will reduce its value.

Healthcare, Schools, and Other Nearby Services

Imagine buying land in a remote area with no hospital or school nearby. It may look cheap, but the hidden cost is inconvenience and poor resale value.

Hidden Costs of Poor Location Choices

Poor infrastructure means you’ll spend extra on water tanks, solar panels, or private transport. These costs add up quickly.

Mistake 4: Not Taking Expert Help

Property investment is not a solo game. Experts can save you from costly errors.

How Real Estate Agents Simplify the Buying Process

Agents provide updated property listings, market rates, and negotiation skills. However, choose licensed agents to avoid middlemen fraud.

Why Engineers and Surveyors Matter

Engineers ensure the land is stable, especially in earthquake-prone zones. Surveyors confirm the actual size matches the documents.

Legal Advisors: Your Safety Net Against Scams

Lawyers double-check ownership, taxes, and future risks. Think of them as your insurance against fraud.

Mistake 5: No Financial Plan

Many buyers save enough for the land price but forget about hidden costs.

Accounting for Taxes, Fees, and Commissions

Buying property in Nepal comes with:

- Registration tax (4–5% of property value)

- Agent fees (2% or above)

- Documentation charges & Interest on bank financing

Emergency Fund for Maintenance and Hidden Expenses

Unexpected expenses like soil testing, compound walls, or renovation can arise. Always keep a buffer fund.

Long-Term Financial Planning for Property Investment

Property is a long-term commitment. Plan for property tax, maintenance, and possible mortgage payments.

Golden Rule: Keep savings for at least 6 months to 1 year after purchase.

Tips to Make a Safe Real Estate Investment in Nepal

- Do a title search before making payments

- Inspect the property personally

- Negotiate smartly and put everything in writing

- Consult experts before finalizing

FAQs About Buying Land or a House in Nepal

Q1. What documents should I check before buying land in Nepal?

You must check the Lalpurja, tax clearance papers, and registration documents at the Land Revenue Office.

Q2. How can I know the real market price of land?

Compare government valuation with recent local transactions and consult multiple brokers.

Q3. Is it safe to buy property without a lawyer?

No. Always involve a lawyer to verify papers and draft agreements.

Q4. What are the hidden costs of buying property in Nepal?

Registration tax, agent commission, legal fees, and infrastructure costs.

Q5. Can foreigners buy land or a house in Nepal?

Currently, foreigners cannot directly own land in Nepal, but they may invest through business ventures with approval.

Q6. What’s the biggest mistake first-time buyers make?

Not researching the property’s legal status and future development plans.

Conclusion: Smart Decisions Lead to Safe Investments

Buying land or a house in Nepal can be rewarding if you avoid common mistakes. By researching properly, verifying legal papers, checking facilities, seeking expert help, and planning your finances, you can secure both your home and your future.Remember: Be smart. Check well. Invest safely!